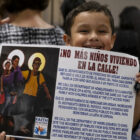

San Francisco is not alone in its public housing woes and a homeless activist group’s recent report said it is up to the federal government to lay groundwork for housing to end homelessness.

Recent attempts by policymakers to create and preserve housing are just the first steps to housing reform, the Western Regional Advocacy Project wrote in an update of its 2006 report, "Without Housing: Decades of Federal Housing Cutbacks, Massive Homelessness and Policy Failures." The update was released in July.

The San Francisco-based network of homeless organizations said the rise in homelessness over the past 30 years is directly related to two factors: the slashing of affordable-housing programs and increased tax breaks for wealthy homeowners. The report drew from government data and other sources in making those correlations.

"What we are documenting is a 35-year disinvestment in housing that’s not going to be resolved in a short-term approach," said Becky Dennison, co-director of the Los Angeles Community Action Network, an anti-poverty advocacy group and a member of the Western Regional Advocacy Project.

In the four years since the original report, the economic picture has grown bleaker. In 2009, foreclosures drove 3.4 million families out of their homes, with unemployment as the leading cause. The Obama Administration recently added $3 billion in funding to help unemployed homeowners meet mortgage payments under a plan from the 2008 Wall Street bailout, the Troubled Asset Relief Program.

The advocacy project cited the drastic reduction in funding to the Housing and Urban Development Department’s Low-Income Budget Authority. In 1978 funding for low-income housing was at $77.3 billion. But by 2004, constant dollar funding dropped to $17.6 billion. Since then, the only substantial increase in funds came last year with an infusion of stimulus funds.

Despite the administration’s increase in funding for homeless assistance, affordable-housing programs continue to decline.

“Congress could easily authorize enough funding to keep public housing and Section 8 funded and keep units functioning," said Sara Shortt, director of Housing Rights Committee of San Francisco. "The political will is not there."

Shortt sees a scarcity of livable units as a result of continued defunding. In December 2009, the San Francisco Housing Authority wrote in a memo that the average waiting time to move into a unit is 10 years. The next month, they closed their waiting list which had a 5-to-1 ratio: It had 29,997 people in line for 6,262 units, with 104 units vacant at any given time.

"Unfortunately, the federal government is seeing public housing in such poor shape," Shortt said. "The only thing to bring it back is full demolition and rehabilitation. In that, there is a lot of possibility for privatization."

That prospect could occur under a HUD plan called Transforming Rental Assistance. Under that plan, 280,000 units would be mortgaged off to private investment.

The advocacy project said it would be likely that the HUD plan would prioritize better-kept properties to attract private investors. Also, no tenant protection would be assured.

Meanwhile, federal housing expenditures are climbing for homeowners, whose costs are subsidized by deductions on their mortgage interest. At $104 billion, the mortgage interest deduction is the second largest tax break. The largest tax break is employer-paid health insurance at $177 billion a year.

The deduction yields a value of $5,459 to households making over $250,000 per year, but only $91 to those earning less than $40,000, according to the Tax Policy Center of the Brookings Institution.

Because of the disparity, the deduction fails to increase homeownership, economists told policymakers in August at a HUD-sponsored conference in Washington, D.C., Mark Zandi, an economist with Moody Analytics, criticized the deduction as too costly for a government with an $8.8 trillion debt.

Mary Canning, dean of the taxation and accounting schools at Golden Gate University, disputes the critiques of the deduction. "I don’t see an abuse in the system there," she said.

Democratic and Republican lawmakers are unlikely to repeal the popular homeowners’ deduction. Modest recommendations made by a panel of George W. Bush appointees to reform the tax code also fell on deaf ears. More recently, the bipartisan National Commission on Fiscal Responsibility and Reform proposed a change in the deduction including eliminating second homes, primary-home mortgages of more than $500,000 and home-equity loans.

Overall, the advocacy project wants new priorities in federal domestic policy. These include regulating housing finance, extending current Section 8 contracts another 20 years and diverting military spending to domestic poverty programs.

A version of this article was published in the fall 2010 edition of the San Francisco Public Press newspaper. Read select stories online, or buy a copy.