To help employees suffering "additional financial stress" from pay cuts and furloughs, the University of California-San Francisco is letting workers borrow their lost wages and repay the money — with interest.

But employees hoping to tap a UCSF emergency loan fund for help paying rent or bills are out of luck. These don’t count as "an unplanned emergency situation."

Starting Oct. 1, full-time employees making $60,000 a year or less can apply for a single hardship loan from the new "Special Temporary Furlough Employee Emergency Loan Program." The maximum loan equals an employee’s pay cut, which ranges between 4 percent and 10 percent based on the 11 to 26 unpaid days that faculty and staff must take in the next year. The Oct. 1 paychecks will be the first to reflect the cuts, which began Sept. 1.

UCSF lists several examples of unplanned emergencies: "unanticipated break down of only car, death or terminal illness of an immediate family member, payment of security deposit for an apartment necessary as a result of divorce, domestic violence, sudden eviction, or emergency non-elective surgery."

What doesn’t count? Being behind on rent, bills, taxes, insurance or legal fees. Tuition also does not qualify. And part-time, casual, contract, student and leased employees are not eligible.

Loan payments will be deducted from monthly paychecks over 24 months, plus interest, currently 3.66 percent. That rate will change next month, but UCSF officials haven’t said whether it will go up or down. The temporary program ends Aug. 31, 2010.

For struggling workers who do not qualify for a furlough loan, the university also offers its regular emergency loan fund, so long as they haven’t already borrowed from the school within the past year.

Why does UCSF have money to loan if it had to cut salaries to save money?

"The answer is money for this program is provided through the UCSF Short Term Investment Pool and because employees begin to repay the University with interest immediately, the loans are possible," Corinna Kaarlela, director of news services at UCSF’s Department of Public Affairs, wrote in an e-mail to the Public Press.

Many employees and union leaders aren’t buying the explanation.

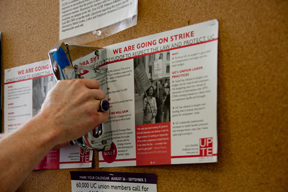

"It clearly shows that they have the money," said Kevin Rooney, president of the University Professional and Technical Employees Local 7-UCSF. "They don’t need the savings from the employee pay cuts and the furlough program."

Rooney’s union, which represents 9,000 UC workers, is negotiating a new contract, along with the pay cuts and furloughs.

State Sen. Leland Yee, a critic of UC policies and governance, called the furlough loan program "more of a PR stunt than anything else.”

"It’s like, ‘we feel guilty, we feel bad that we give you very little increases, we’re furloughing you, we’re cutting back on your hours — all kinds of bad things — and then, by the way, we realize we did all these bad things, so we’re going to try and make it up to you with this loan,’ " he said.

UC Berkeley spokeswoman Marie Felde said Cal is not offering furloughs loans. The UC Office of the President did not respond to queries about the other eight campuses.

In July, the UC Board of Regents approved $184 million in pay cuts and furloughs to help close the system’s $813 million budget gap. UC President Mark Yudof said the furlough plan would save jobs and preserve the quality of education.

Reach the reporter at cmorales[AT]public-press.org.